Understanding Bitcoin: How It Works and Its Expanding Influence in a Digital Economy

Bitcoin, launched in 2009 by the pseudonymous Satoshi Nakamoto, is the pioneering decentralized digital currency that operates without a central authority. For professionals in finance, technology, or business, understanding Bitcoin’s mechanics and its broader impact is essential as it continues to reshape the global economic landscape. This blog explores how Bitcoin functions, its role in spawning altcoins and payment platforms, the rise of token swapping and exchange-traded funds (ETFs), and its potential future, including integration into enterprise systems like LucidTrac’s community ERP for streamlined payments.

How Bitcoin Works: The Foundation of a Digital Revolution

At its core, Bitcoin is a peer-to-peer electronic cash system built on blockchain technology a distributed ledger that records all transactions across a network of computers. Transactions are grouped into blocks, cryptographically secured, and added to the chain through a process called mining. Miners use computational power to solve complex mathematical problems, validating transactions and earning newly minted bitcoins as rewards. This proof-of-work consensus mechanism ensures security and prevents double-spending without intermediaries like banks.

Bitcoin’s supply is capped at 21 million coins, a feature that distinguishes it from fiat currencies subject to inflation. As of March 28, 2025, approximately 19.6 million bitcoins are in circulation, with the remainder to be mined gradually until around 2140. Transactions are pseudonymous, identified by wallet addresses rather than personal data, offering a degree of privacy while maintaining transparency on the public ledger. For professionals, this blend of scarcity, security, and decentralization positions Bitcoin as a unique asset class often dubbed “digital gold.”

Spawning Altcoins and Payment Platforms

Bitcoin’s success inspired the creation of thousands of alternative cryptocurrencies, or altcoins, each aiming to address perceived limitations or explore new use cases. Ethereum, launched in 2015, introduced smart contracts self-executing agreements coded on the blockchain enabling decentralized applications (dApps) and expanding blockchain’s utility beyond simple transactions. Other altcoins, like Litecoin and Ripple (XRP), optimized for faster payments or cross-border transfers, emerged as competitors or complements to Bitcoin.

This proliferation also birthed platforms designed for payments and financial services. Stablecoins like Tether (USDT) and USD Coin (USDC), pegged to fiat currencies, provide stability for transactions, bridging traditional finance and crypto. Payment platforms such as BitPay and Coinbase Commerce allow businesses to accept Bitcoin and altcoins, converting them to fiat instantly if desired. These developments reflect Bitcoin’s role as a catalyst, driving innovation in digital payments and challenging conventional financial systems.

Token Swapping: Enhancing Liquidity and Flexibility

As the crypto ecosystem grew, so did the need for interoperability. Token swapping exchanging one cryptocurrency for another became a cornerstone of decentralized finance (DeFi). Platforms like Uniswap and PancakeSwap, built on Ethereum and Binance Smart Chain respectively, use automated market makers (AMMs) to facilitate swaps without traditional order books. Users deposit tokens into liquidity pools, earning fees while enabling seamless trades.

For professionals, token swapping offers liquidity and portfolio diversification without relying on centralized exchanges. However, it introduces risks like impermanent loss and smart contract vulnerabilities. As of 2025, cross-chain bridges such as those connecting Ethereum to Solana further enhance swapping by allowing assets to move between blockchains, a trend likely to accelerate as interoperability becomes a priority.

Bitcoin ETFs: Bridging Crypto and Traditional Finance

Bitcoin’s integration into mainstream finance took a significant leap with the approval of spot Bitcoin exchange-traded funds (ETFs) in the United States in January 2024. Unlike futures-based ETFs launched in 2021, spot ETFs offered by firms like BlackRock (iShares Bitcoin Trust, IBIT) and Fidelity track Bitcoin’s real-time price, providing investors exposure without direct ownership. By March 2025, these ETFs have amassed billions in assets under management, reflecting institutional adoption and investor demand.

For professionals, ETFs simplify access, eliminating the need to manage wallets or navigate crypto exchanges. They also signal regulatory acceptance, potentially stabilizing Bitcoin’s price volatility. However, they don’t fully replicate the decentralized ethos of holding Bitcoin directly, as custodianship remains centralized.

The Future of Bitcoin and Digital Assets

Looking ahead, Bitcoin’s future hinges on adoption, regulation, and technological evolution. Its price, hovering near all-time highs in 2025, reflects optimism about its store-of-value narrative, especially amid global economic uncertainty. Yet, scalability remains a challenge Bitcoin processes roughly 7 transactions per second compared to Visa’s thousands. Solutions like the Lightning Network, a second-layer protocol, aim to boost speed and reduce costs, making Bitcoin more viable for everyday payments.

Altcoins and DeFi will continue to diversify the ecosystem, but Bitcoin’s dominance around 50% of the crypto market cap suggests it will remain the anchor. Regulatory clarity, particularly in major markets like the U.S. and EU, will shape its trajectory. Central bank digital currencies (CBDCs) may compete, but Bitcoin’s decentralized nature offers a counterpoint to state-controlled systems.

Integration with LucidTrac Community ERP: Streamlining Payments

For businesses, integrating Bitcoin into enterprise resource planning (ERP) systems like LucidTrac’s community ERP exemplifies its practical potential. LucidTrac, designed for community-driven organizations, can leverage Bitcoin’s blockchain for transparent, efficient payment processing. By embedding crypto wallets and smart contracts, it enables real-time invoicing, cross-border payments, and automated settlements reducing reliance on slow, costly banking rails.

Imagine a nonprofit using LucidTrac to accept Bitcoin donations globally, instantly converting them to local currency or holding them as an asset. Or a small business streamlining supplier payments without intermediaries. Such integration cuts transaction fees, enhances auditability, and aligns with the growing trend of digital asset adoption. As more platforms adopt similar capabilities, Bitcoin could transition from a speculative asset to a functional tool in enterprise workflows.

Conclusion: A Maturing Asset Class

Bitcoin’s journey from a niche experiment to a global phenomenon underscores its disruptive power. For professionals, it’s more than an investment it’s a technological and economic shift demanding attention. Its influence on altcoins, payment platforms, token swapping, and ETFs highlights its versatility, while integrations like LucidTrac ERP signal a future where digital assets enhance operational efficiency. As we navigate 2025 and beyond, Bitcoin’s role will evolve, balancing innovation with the challenges of scale, regulation, and adoption. For those ready to engage, the opportunities are as vast as the blockchain itself.

Share this Blog Post: https://lcdtrc.link/emfuk89

In Case you Missed It - Seach by Tags!

Visit our YouTube channel at https://youtube.com for help and videos about the #LucidTrac Platform.

Introducing the #softwareKing Motivational Mobile App Section: Unleash Your Self Motivational Power

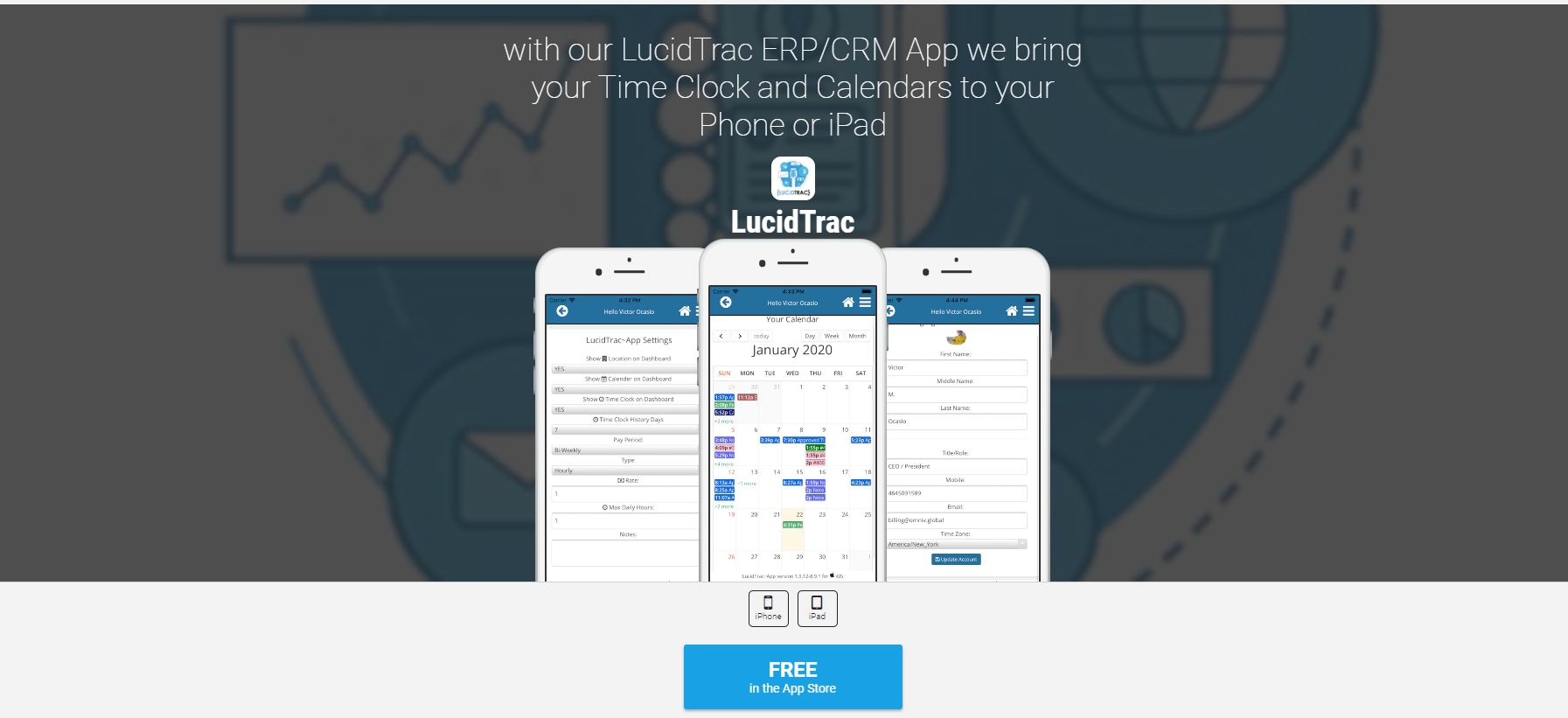

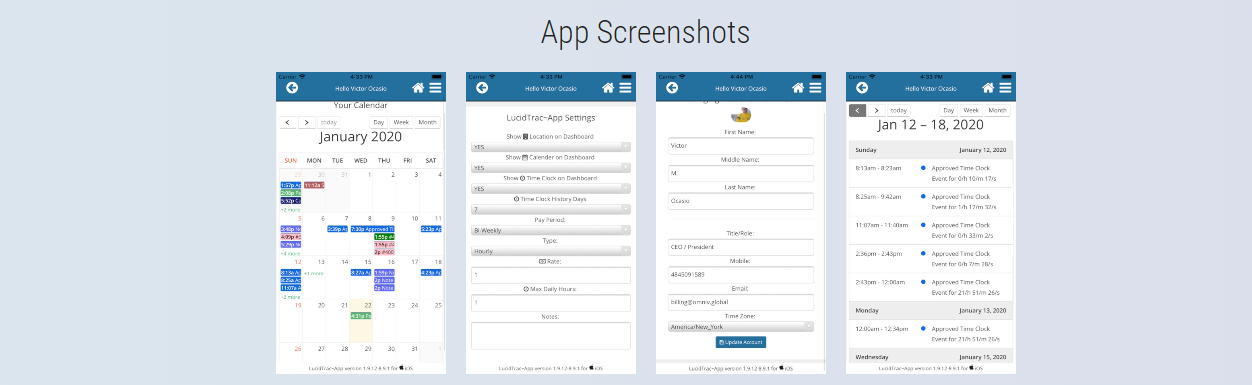

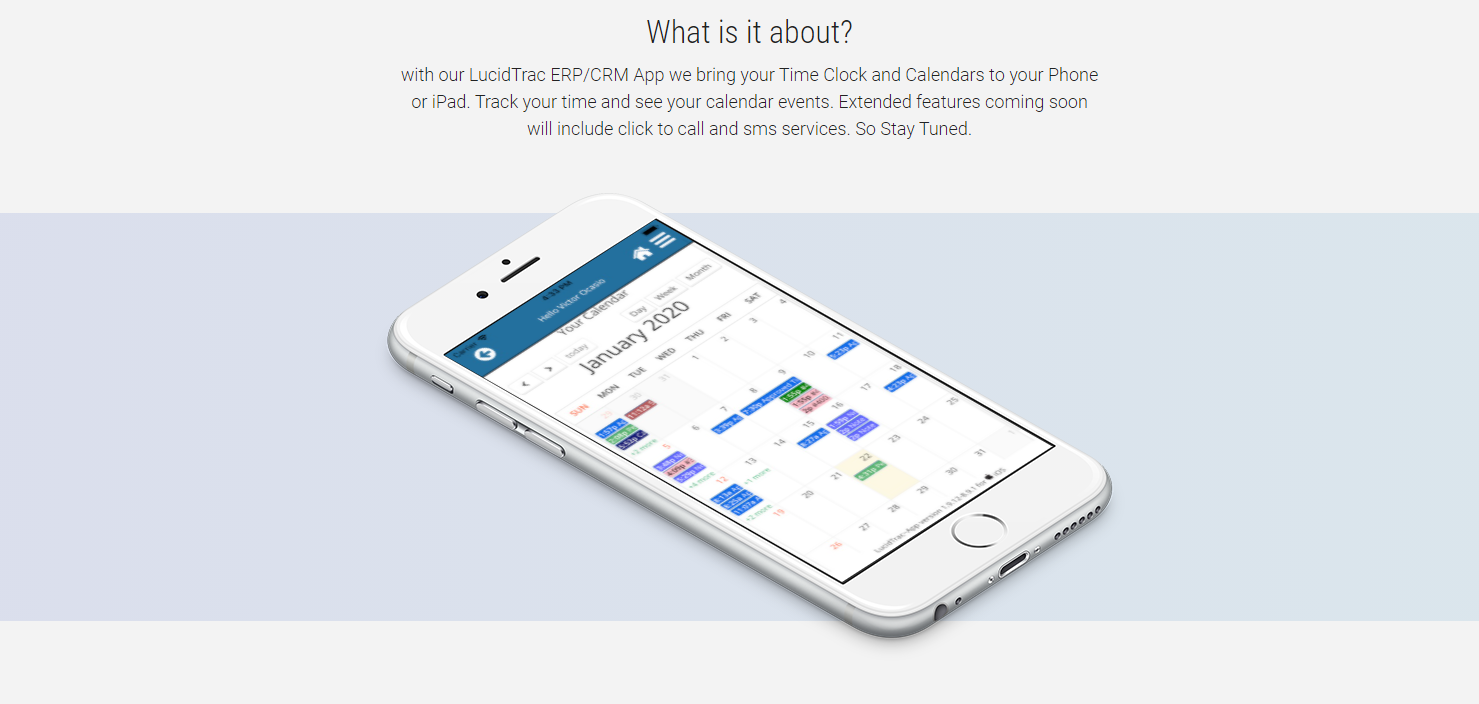

At LucidTrac ERP, we are proud to announce the launch of an exciting new section within our Mobile App: #softwareKing. Designed to inspire, empower, and uplift, #softwareKing brings you an exclusive collection of Daily Motivational Videos, curated to fuel your ambition and drive your success.

With the #softwareKing section, we believe that motivation knows no bounds. That's why we have made these inspirational videos accessible to everyone, without the need for an account or any subscription fees. Simply download our app, and immerse yourself in a world of powerful messages and transformative insights.

Compare LucidTrac to other online platforms

To help you get a better understanding of your needs by comparing LucidTrac to other online ERP / SaaS platforms.

LucidTrac offers a comprehensive solution to streamline all of your business operations.

With its fully customizable features, LucidTrac allows you to tailor the platform to meet the specific needs of your business.

Compare LucidTrac to

Zoho CRM

Compare LucidTrac to

Zendesk CRM

Compare LucidTrac to

Freshdesk CRM

Compare LucidTrac to

Salesforce CRM

Compare LucidTrac to

Monday CRM

Compare LucidTrac to

HubSpot CRM

Compare LucidTrac to

Keap CRM

Compare LucidTrac to

Sugar CRM

Compare LucidTrac to

SherpaDesk CRM

| Comparing Feature | LucidTrac | Zoho CRM | Zendesk CRM | Freshdesk CRM | Salesforce CRM | Monday CRM | HubSpot CRM | Keap CRM | Sugar CRM | SherpaDesk CRM |

| Price | $300 Unlimited Users | $49 Avg/Per User | $149 Avg/Per User | $109 Avg/Per User | $125 Avg/Per User | $99 Avg/Per User | $99 Avg/Per User | $49 Avg/Per User | $45 Avg/Per User | $49 Avg/Per User |

| Free Trial | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Support 24/7 | Yes | Yes | No | No | No | No | No | No | No | No |

| Developer API | Yes | Yes | No | Yes | No | No | No | No | No | Yes |

| Dashboards | Yes | Yes | No | Yes | No | Yes | No | No | Yes | No |

| To-Dos | Yes | Yes | No | Yes | No | Yes | No | No | Yes | Yes |

| Products & Assets | Yes | Yes | No | Yes | No | Yes | No | No | Yes | Yes |

| User Roles | Yes | Yes | No | Yes | No | Yes | No | No | Yes | No |

| 2FA (Two-Factor Authentication) | Yes | Yes | No | Yes | No | Yes | No | No | Yes | No |

| Multi Method Importing | Yes | Yes | No | No | No | Yes | No | No | No | No |

| Documents & Templates | Yes | No | No | No | No | No | No | No | No | No |

| iOS/Android Apps | Yes | Yes | No | No | No | No | No | No | No | Yes |

| Statistics & Reporting | Yes | Yes | No | Yes | No | No | No | No | No | Yes |

| Storage | 500G Base Node | 1G | 1G | 1G | 1G | 1G | 1G | 1G | 1G | - |

| Monthly Payments | Yes | Yes | No | Yes | No | No | No | No | No | Yes |

| Campaigns | Yes | Yes | No | Yes | No | No | No | No | No | No |

| Exporting Services | Yes | Yes | Yes | Yes | No | No | Yes | No | Yes | No |

| Emailing | Yes | Yes | No | Yes | No | No | No | No | No | No |

| SMS Inbound/Outbound | Yes | Yes | No | Yes | No | No | No | No | No | No |

| Voice Calling Inbound/Outbound | Yes | Yes | No | Yes | No | No | No | No | No | No |

| IVR Services | Yes | Yes | No | Yes | No | No | No | No | No | No |

| Google Calendar/Authentication | Yes | Yes | No | Yes | No | No | No | No | No | No |

| Service Tickets / Time Tracking | Yes | Yes | No | Yes | No | No | No | No | No | Yes |

| Email to Service Ticket Services | Yes | Yes | yes | Yes | No | No | No | No | No | Yes |

| Time Clock / Payroll Exporting | Yes | No | No | No | No | No | No | No | No | No |

| Networking / IP & Host Management | Yes | No | No | No | No | No | No | No | No | No |

| Web Forms / Landing Pages | Yes | Yes | No | Yes | No | No | Yes | No | No | No |

| Invoice/Payment Collections Tools | Yes | No | No | No | No | No | No | No | No | No |

| Customized Programming | Yes | No | No | No | No | No | No | No | No | No |

Mr. Kevin Johnson

BlueSpruce Consulting Services, LLC.

Mr. Craig Stonaha

CEO Laughing Rock Technologies, LLC.

John Adams

President/CEO - RDI

Dennis Canlas

USCR

Brian Gomez

Gomez Check Cashing

Mr. Michael Graziano

Prime Time Mortgage Corp.

Mr. Nicholas Tannous

NWT Enterprises Ltd - San Juan, Trinidad and Tobago

Mrs. Cynthia Garrett

Berks ENT - Reading PA